|

|

|

INVESTMENTS -

PREVIOUS PROJECTS

RER has historically capitalized on under-valued market

opportunities. RER and its principals have a successful

track record with the purchase, repositioning and sale

of all real estate product types. Representative examples

involving different product types include:

|

|

1770 Fennell Street, Maitland, FL - Acquired multiple non-performing notes at a discount with a combined face value of $2,600,000 that were secured by a 1st lien mortgage on a 15,408sf, two-story, owner-occupied, multi-story office building located in Maitland, Florida. RER negotiated a settlement, forgiving the deficiency in exchange for a 10yr NNN lease with the previous owner-occupant that required a large security deposit in case of lease default. Upon lease execution and title transfer, the property was sold to a foreign investor, resulting in a 22.5% cash-on-cash return. |

| |

|

|

|

|

Innovation Executive Center - 50.6

acre commercial land in Prince William County, Virginia.

This parcel is part of the INNOVATION Corporate

Center in Prince William

County, Virginia which includes George Mason University's

Prince William County Campus, the FBI, the NIH, and Comcast Cable.

The development of 600,000 sq. ft. of office, flex and data centers

on this site will be a key addition to the Innovation

Corporate Center expansion plan. Click here for more info... |

| |

|

|

|

|

2030 West McNab Road - 2030 W McNab Road, Ft. Lauderdale, FL - Acquired a non-performing note at a discount that was secured by a 1st lien mortgage on a 103,000 sf, owner-occupied, single-story office/warehouse building located in Ft. Lauderdale, Florida. RER reached a settlement on the property, releasing the borrower from its guaranty for a cash settlement. After renovating the property, it was sold in 22 months to an owner/operator generating a 131% IRR and 3.6 plus miltiple. |

| |

|

|

|

|

EuroBank Loan Portfolio - RER Equities, Inc. acquired fifty one performing, sub-performing and non-performing notes secured by various commercial real estate and related assets. The aggregate unpaid balance of the notes totals $33,413,513. The seller was Coral Gables, Florida based EuroBank, a subsidiary of Banco do Brasil S.A. The notes are secured by real estate assets in Dade, Broward and Palm Beach counties. RER monetized this portfolio over a three year period, returning the initial capital investment in 18 months and producing an unlevered 46.5% IRR. |

| |

|

|

|

|

Westmark One and Westmark

Two - The former headquarters of Capitol One located in the heart of Richmond, Virginia's premier office corridor

in the Innsbrook area. Renamed Westmark Office Park, this 40 acre office park includes two 5-story corporate headquarters quality

office buildings with tenants including Philip Morris, SunBank and Magellan Health. In addition to the 420,000 feet of office space,

RER has developed a free standing bank branch, and sold off pads for a 11 story deluxe Drury hotel and a 100 unit mid-rise apartment project. |

| |

|

|

|

|

Richmond Office Building Site

(Build To Suit) - Five acres of

office land fronting on Cox Road and with Interstate 64 exposure upon which was developed a 100,000 square

foot suburban office building in the Innsbrook

area of suburban Richmond, Virginia. |

| |

|

|

|

|

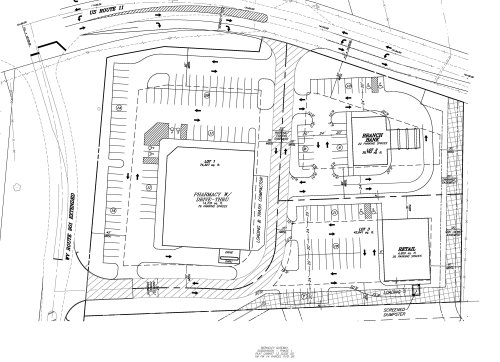

Berkeley Gateway

- Commercial/Retail Site - This site is ideally located just north of Martinsburg, West Virginia

at the Spring Mills interchange on Interstate 81,

across the street from a new Super WalMart. This land was site planned, engineered,

and developed for the construction of a 3.5 acre corner commercial/retail site.

This commercial site was sold to a regional hospital. |

| |

|

|

|

|

Berkeley Ridge Community – This 35-acre site located north

of Martinsburg West Virginia and one quarter mile east of

Interstate 81 was purchased by RER in 2008. We were able to

obtain final plat approval for a 277-unit townhouse community. Upon completion

of engineering plans and all governmental approvals we sold the site to DR

Horton, the nation’s largest homebuilder, creating a profit of over $22,600 per lot and an over 6 multiple. |

| |

|

|

|

|

Richmond Bank Branch Site - RER Equities, Inc. developed and sold this West Broad Street bank branch site upon

which a 3,400 square foot bank facility is being constructed featuring four

drive-in teller lanes and twenty-four parking spaces. |

| |

|

|

|

|

950 Herndon Parkway, Herndon, Virginia A 45% vacant office building in Northern Virginia. RER increased the occupancy of this 92,000 square foot building to 100% during a three-year period and changed the tenant mix from small local companies leasing small suites of space to larger corporations with healthy credit ratings that occupied significantly larger spaces. The building was sold approximately three years after acquisition generating an internal rate of return over 70%. |

| |

|

|

|

|

Prince Williams Commons, Woodbridge, Virginia A 52,000 square foot big box retail facility that was 100% vacant during its acquisition negotiations. The property was located in a large multi-owner shopping center development at the intersection of two major commuter roads. RER located a national tenant that committed to lease 54% of the space under a long term lease whose rental income met all of the financial obligations related to the property. RER repositioned the remainder of the property into five smaller bays and fully leased the remaining space. The property was sold five years after acquisition resulting in an IRR over 20%. |

| |

|

|

|

|

Cambridge Station Apartments A distressed 205-unit complex in Columbia, South Carolina, was in poor physical condition with an undesirable tenant mix and 65% rent collections. RER managed this property back to stabilized occupancy and condition, then sold it, generating an internal rate of return of 45% over an eighteen-month period. |

| |

|

|

|

|

RER acquired a non-performing $19 million real estate loan portfolio with predominantly raw land and partially finished residential lots in northern Virginia as collateral. RER perfected lien positions and re-negotiated terms with borrowers, eventually generating an IRR of 75% over a four-year period. |

As demonstrated in the examples above, RER has a solid

track record in acquiring and turning around under-performing

real estate assets to deliver significant value to its

investors.

|

|