|

|

|

INVESTMENTS -

CURRENT PROJECTS

RER has numerous projects underway in various stages of development. Below are descriptions of some of these exciting projects:

|

|

Las Vegas Raiders Corporate HQ and Practice Facility - RER owns the new Las Vegas Raiders, build-to-suit corporate headquarters and practice facility located in Henderson, Nevada. The Property, which is 100% leased to the Raiders Football Club under a 30 year lease with seven 10-year extensions, is situated on 24.5 acres of land immediately adjacent to the Henderson Executive Airport and has a total of 335,000 square feet of building area. The facility features 135,000 feet of office space, a 150,000-foot indoor practice facility and a 50,000-foot strength performance center. The three-story Class A office building includes a full broadcast and filming studio and an auditorium. The fieldhouse has both a full and a ˝ indoor practice field with 110-foot ceiling clearance. The exterior is improved with an Olympic size swimming pool as well as one natural and two artificial turf football fields.

|

| |

|

|

|

|

Ozarks Outdoor Resort - RER Ventures owns a 341 acre RV resort with one mile of frontage on the Meramec River in Leasburg, Missouri, south of St. Louis. This 450 site park also has lodgings including twenty motel units, three chalets and 27 luxury cabins. Amenities include playgrounds, swimming pool,, high speed WIFI throughout the park, an aerial/zip line experience, a conference center, outfitters and convenient store and a bar/restaurant. Ozark Outdoor provides its guests with a variety of river float trips launching over 3,000 guests each week on large river rafts, kayaks and canoes.

|

| |

|

|

|

|

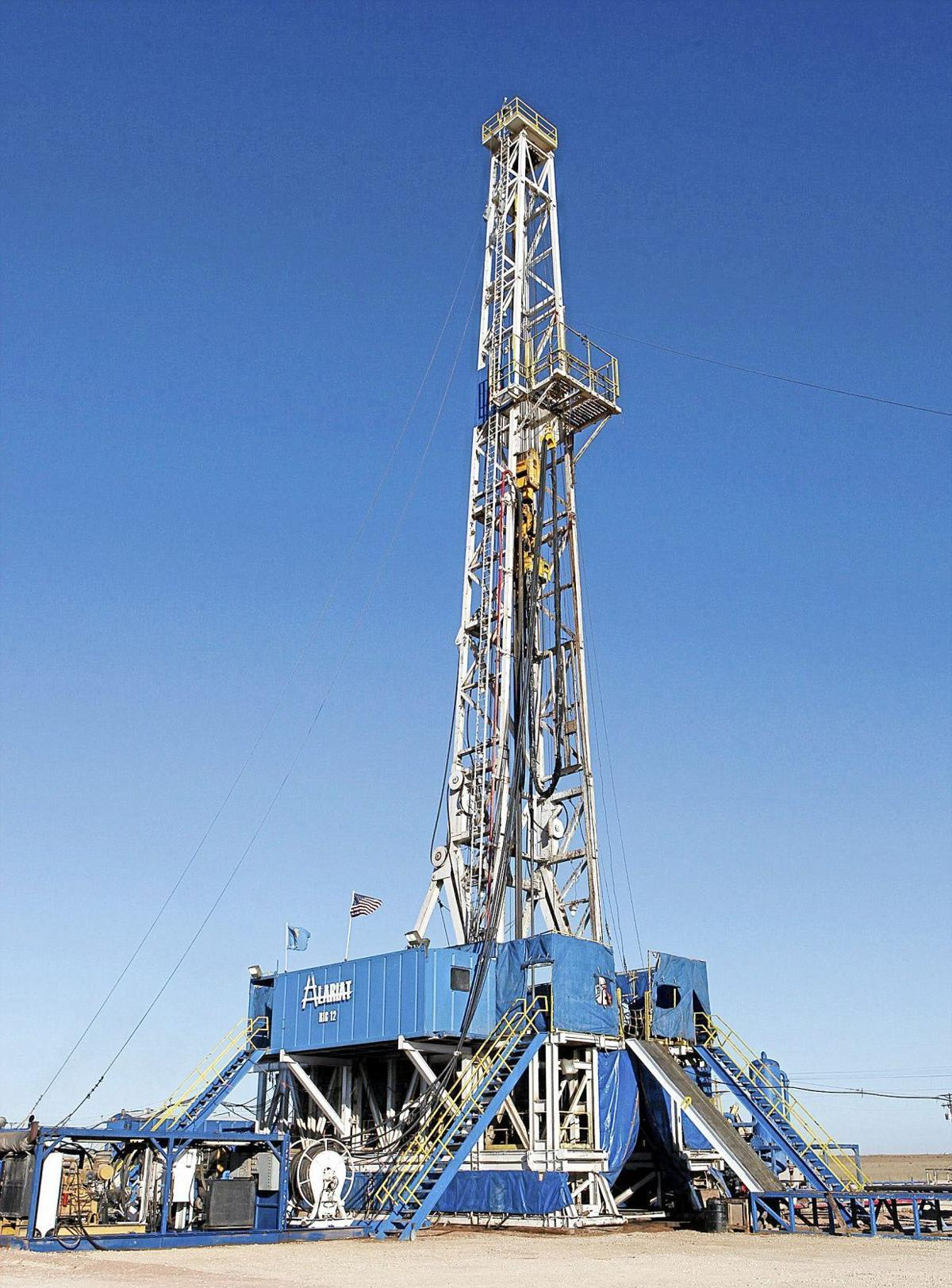

Foreman Butte Oil Field- Via a special purpose entity (CK Energy LLC); RER Ventures owns an 80% interest in the Foreman Butte Oil Field. With rights to drill on 23,000 contiguous gross acres across North Dakota, we are operating 27 wells and identifying sites for new vertical and lateral wells. Independent reserve reports currently project annual revenues of approximately $6.67 million from existing production. We believe the trending growth in demand of global energy needs will continue and technological improvements will continue to drive down extraction and operational costs. These factors should provide continuing strong tailwinds towards the economic viability of the project.

|

| |

|

|

|

|

Lake Huron RV Park - RER Ventures acquired a 99 acre RV park in North East Michigan across from Lake Huron and featuring its own private lake for $10.5 million. This high volume campground is home to 430 campsites including 38 cabins. RER is investing in improvements by increasing the number of sites and cabins and adding enhanced technological capabilities. In addition, we are converting the property to a Jellystone Park National Franchise, broadening the market for this destination R/V resort. In December 2021 the park was sold for $17,650,000. |

| |

|

|

| |

|

|

|

|

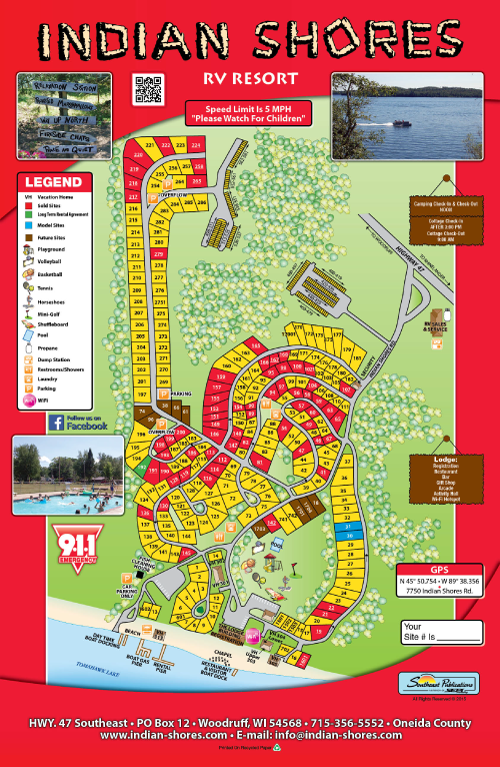

Indian Shores RV Park - RER Ventures has acquired this 86 acre heavily wooded 260 campsite RV park with over 1,000 feet of frontage along the 3,600 acre Lake Tomahawk. The park is a major summer vacation destination in the northern woods of Wisconsin. Due to its natural beauty and its direct access to the most popular chain of lakes in Northern Wisconsin the property attracts both families and retirees. RER is investing in numerous enhancements to the customer experience including property-wide Wi-Fi, additional boats and watercraft, build-out of additional cabins and sites |

| |

|

|

| |

|

|

|

|

Proctor & Gamble Research Campus - RER, in joint venture with Vandercar LLC, acquired this 120-acre research and development site with 700,000 square feet of office and lab space in the Cincinnati suburb of Blue Ash from Procter & Gamble in April 2018. P&G has leased the entire property back on a short-term basis while RER and Vandercar solidify plans for the site redevelopment. The property affords excellent redevelopment prospects as it is a block from a major expressway interchange and adjacent to a golf course and park. To date we have sold the western property with 300,000 square feet of office and lab space to a major regional hospital bringing 2,000 new jobs to the community and are in negotiation include the creation of new office space for over 3,000 employees as well as retail and hotel facilities to accommodate the needs of those tenants. |

| |

|

|

| |

|

|

|

|

Madison Square - 25-acre mixed use property with over 600 feet of frontage on Lee Highway (Route 29), one of Northern Virginia’s major arteries. This project involves the development of 170,000 square feet of retail, banking and office space as well as 25 single family home sites. |

| |

|

|

| |

|

|

|

|

RER Outdoor Marketplace, LLC -

The Opa Locka Hialeah Flea Market portfolio, made up of three land parcels totaling over 72 acres in Miami, Florida, was acquired for future development with a large REIT partner. Mr. Kallivokas is also the Managing Member of RER Outdoor Marketplace LLC, the firm that operates this 200 plus tenant property. The transaction closed in July 2017. Significant renovations and improvements have been implemented that have resulted in significant increases in traffic and revenues. Ultimately, the property can be developed into 3,220 apartment units. |

| |

|

|

| |

|

|

|

|

University Bridge Residences Phase 1 -

RER is a general partner in the development of this 1,244 bed, 886-unit luxury student housing development in conjunction with Global City Development. This 20-story property, situated directly across from the main entrance to Florida International University and its 56,000 students, was financed utilizing a $231 million tax free bond. |

| |

|

|

| |

|

|

|

|

University Bridge Residences Phase 2 -

RER has again teamed with Global City Development in the assemblage and acquisition of 2 acres of land immediately adjoining Phase I of University Bridge Residences. Zoning has been obtained for a twenty-story structure which will be developed in a joint venture arrangement with Toll Brothers as a student housing rental and hold investment property with 350 units and 1246 beds.

|

| |

|

|

| |

|

|

|

|

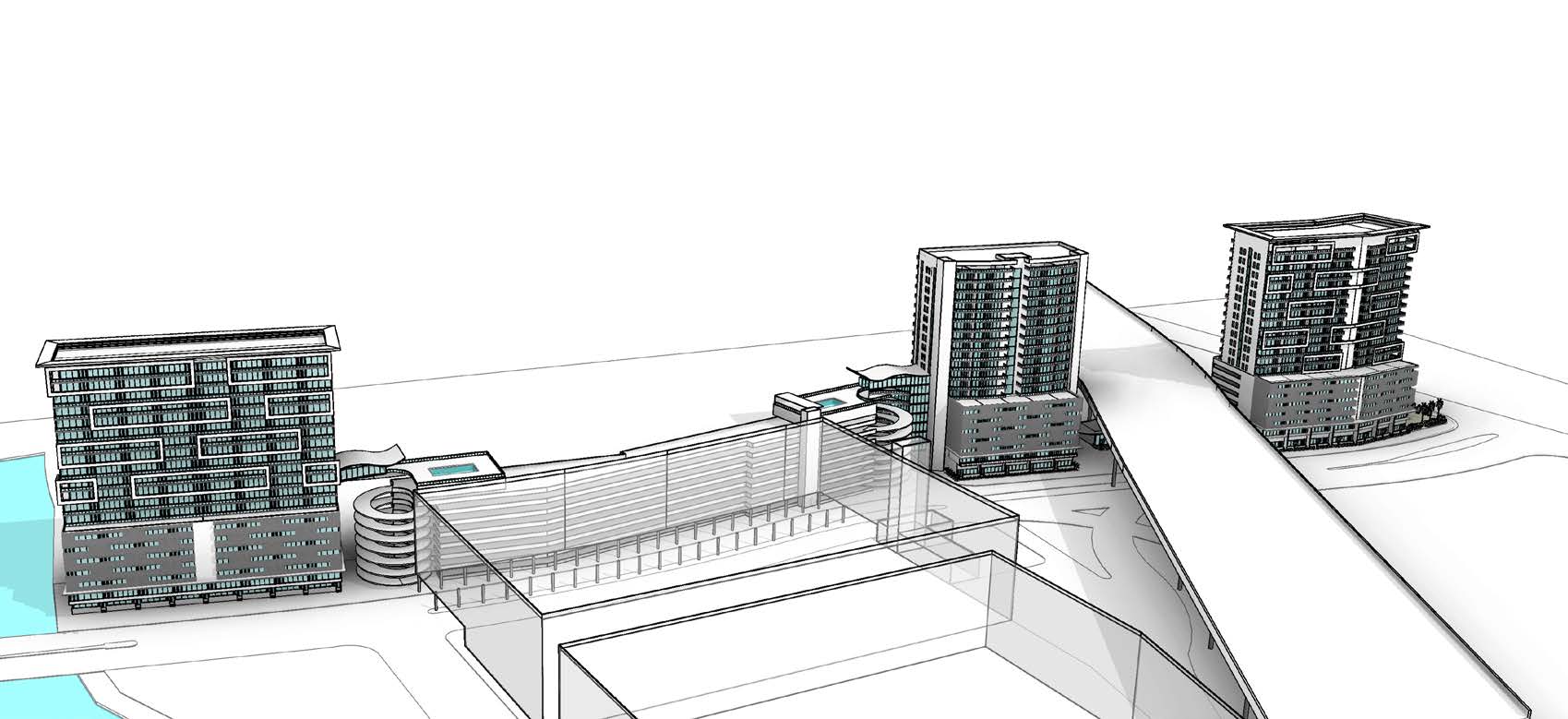

Dadeland 1000+ Unit Multi-Family Development -

RER Ventures with a co-developer has recently acquired a high density mixed use property with plans to incorporate 1000+ luxury multi-family units located in the heart of Dadeland, one of Miami's major commercial/residential corridors, adjacent to the Metro station and straddling a major expressway. Construction is scheduled to begin in 2022.

|

| |

|

|

|

|